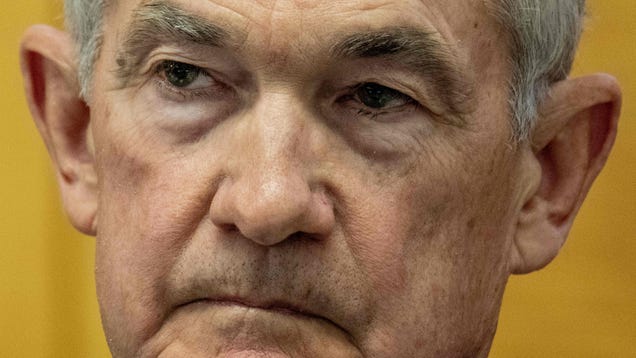

Lots of people would love it if the Federal Reserve cut interest rates soon. Investors want cheaper money. Homeowners want cheaper mortgages. Consumers want cheaper credit card bills. And for a while, there was a lot of pressure on the Fed to give them what they wanted out of fears that holding rates too high would damage the economy. Right now, the federal funds rate—how much banks pay each other to borrow money that the government holds for them—is at 5.5%, the highest it’s been in 23 years. But with the labor market holding firm and inflation coming down, all while GDP numbers are coming in hot, there’s a growing chance that Fed Chair Jay Powell can wait it out.

According to the CME Group, practically nobody in the market expects that the Fed will cut rates at its meeting next week. Back in July, scaredy cats in the bond world made it seem urgent that the rates would come down as early as September. Nope. At one point, people thought there was a 1-in-8 chance the Fed would really start to drop it low with two cuts at the next meeting in March, but it’s now looking less likely that anything happens at all. (In fact, Dallas Fed President Lorie Logan said a couple weeks ago that “we shouldn’t take the possibility of another rate increase off the table just yet.”)

“At next week’s FOMC meeting, we don’t expect the Fed to hint at upcoming rate cuts and it may even maintain its tightening bias in the accompanying statement,” says a note from the research firm Capital Economics. “Frankly, everything depends on the incoming data now and there are a lot of potentially significant releases over the next few weeks that could swing the odds of a March rate cut in either direction.”