A lack of regulation and supervision is largely to blame for the recent banking crisis. That is the conclusion of a recent report from a high-ranking Federal Reserve official. Another report, from the Congressional Research Service, emphasizes crypto’s role. The lack of unanimity is striking.

The recent banking crisis is due, in part, to lax regulation and supervision, according to a report by Michael S. Barr, the Vice Chair of Supervision at the Federal Reserve. The report surveys the regulation and supervision of Silicon Valley Bank (SVB). According to Barr, SVB failed largely due to mismanagement by senior leadership and a lack of oversight by the board of directors.

Trump Deregulated Banks

“We must strengthen the Federal Reserve’s supervision and regulation based on what we have learned. This report represents the first step in that process,” the report states.

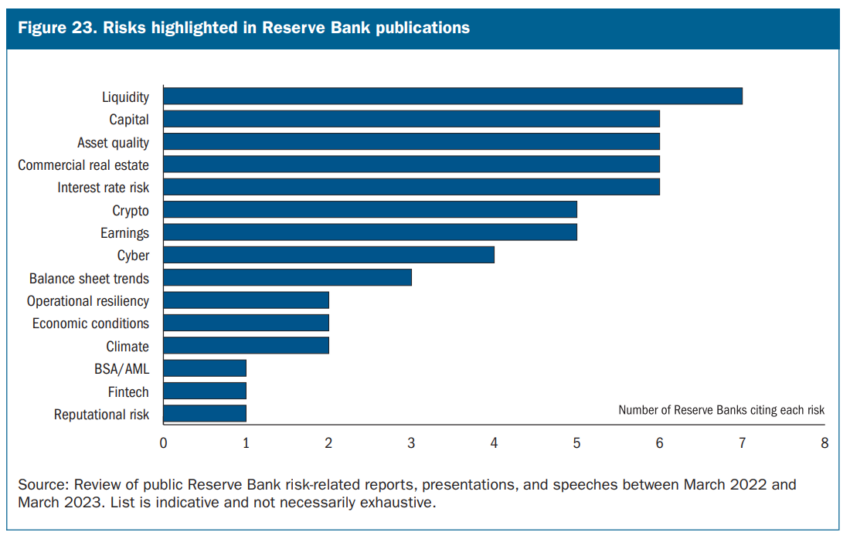

Barr’s report does briefly mention crypto as a risk for banks. But the word “crypto” turns up only three times in a 118-page report. The report largely blames supervisory failures. And it is blunt about who bears a lion’s share of responsibility here.

President Trump dramatically deregulated the banking sector during his four years in office. Including rolling back parts of the Dodd-Frank Act, easing the Volcker Rule, and weakening the Consumer Financial Protection Bureau.

The report states that the passage of the Economic Growth, Regulatory Relief, and Consumer Protection Act in 2019 resulted in “lower supervisory and regulatory requirements” for Silicon Valley Bank. These also included lower capital and liquidity requirements.

Moreover, the report acknowledges that “while higher supervisory and regulatory requirements may not have prevented the firm’s failure, they would likely have bolstered the resilience of Silicon Valley Bank.”

On Friday, March 10, 2023, state regulators shut down Silicon Valley Bank (SVB) after a bank run. The collapse became the second-largest bank failure in United States history and the biggest since the 2007-2008 financial crisis.

Additionally, two other banks in the United States, Signature and Silvergate, also failed in March 2023.

The report highlighted the weaknesses in regulation and supervision, including the need for strengthening supervisory and regulatory frameworks. It emphasizes the importance of strong bank capital and the need to continuously evaluate the supervisory and regulatory framework to spot new and emerging risks.

In Barr’s view, a stronger supervisory framework could enhance the speed, force, and agility of supervision. Especially for firms with rapid growth, concentrated business models, or other high-risk factors.

President Joe Biden has previously urged Congress to introduce tougher regulations. In order to make it “less likely this kind of bank failure would happen again.”

Banks Undone by Withdrawal Demand

In contrast to Barr’s analysis, another recent report by the Congressional Research Service evaluated the role of cryptocurrency in the banking crisis. The document looked at Silicon Valley Bank (SVB), Signature Bank, and Silvergate Bank.

The April 25 report noted all three banks had exposure to the cryptocurrency industry, holding deposits, making loans, and providing payment networks to crypto firms.

Silvergate had the highest concentration in the crypto industry. Over 90% of its total deposits came from crypto client deposits. SVB and Signature Bank had relatively modest exposure.

The report found that there were links between banking failures and specific crypto company failures. Crypto’s volatility contributed to the depletion of deposits. In some cases, banks sold ostensibly safe securities for losses to meet withdrawal demand.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.